Economic Development Program

A. Economic development

1. Developing community business group/micro enterprise group (MEG)

a. Development of MEG

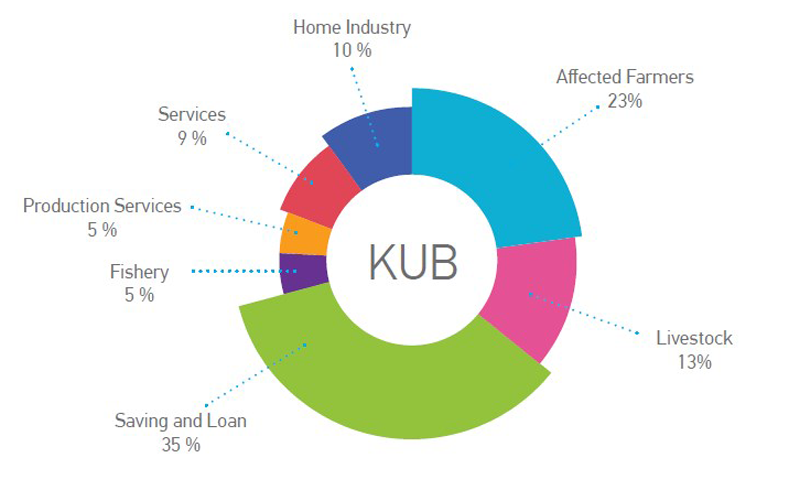

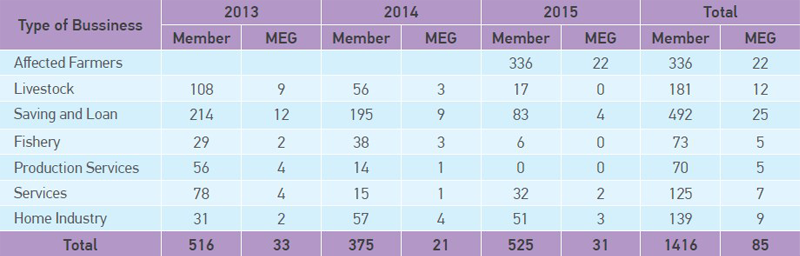

85 MEGs have been developed that consist of 1,416 community members with diversified micro businesses of home industry, production services, saving/loan, services, animal farming & fishery.

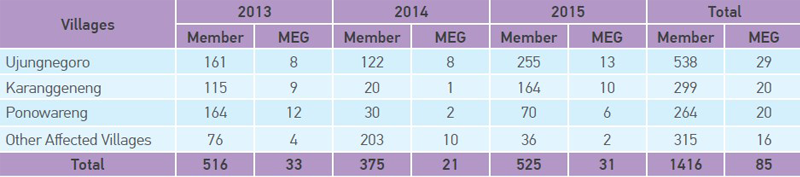

MEGs have been developed in dispersed affected villages and majority of MEGs members are originally from the main affected villages of Ujungnegoro, Karanggeneng and Ponowareng.

b. Form of Support from BPI

Affected community from surrounding of BPI which joined MEG program has received BPI support in form of capacity building training, production equipment, business capital & technical assistance.

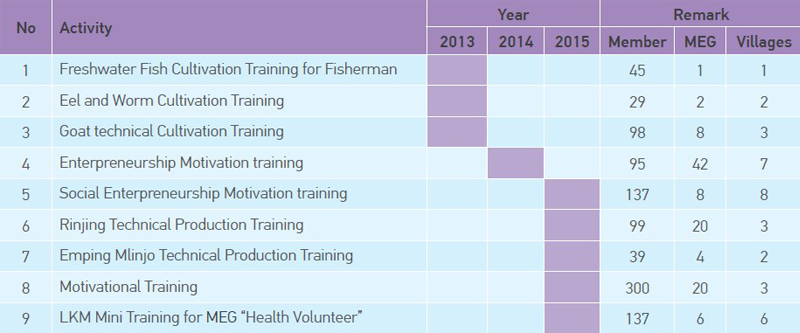

• Training support

BPI has implemented diverse training activities for MEGs members based on their preference & requirement.

• Supporting business capital & production equipment

Beside support in form of training & business capital, BPI is also supporting production equipment for MEG diverse business like sewing machine, mobile harvester equipment, catering & snack production equipment.

2. Developing Microfinance Institution (MFI)

In order to support community business development surrounding BPI, MFIs are developed to provide micro loan and other financial services for affected community businesses, as well as nurturing community saving culture. There are two MFIs development schemes. First is developing three MFIs in three villages of Ujungnegoro, Karanggeneng Ponowareng. The second is Grameen Bank model micro financing with Koperasi Mitra Dhuafa (KOMIDA).

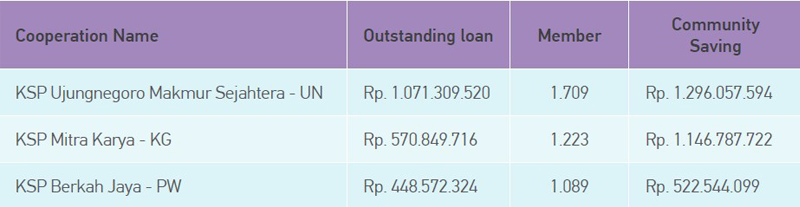

a. Three saving-loan MFIs (cooperatives) in three villages

BPI has been supporting the development of three MFIs since 2013 up until now in form of MFI pre-development, permit, launching, series of training & other capacity building & technical assistance, in cooperation with LDP Bina Mandiri, Batang. Below is summary description of activity & achievement of three MFIs until 31 December 2015:

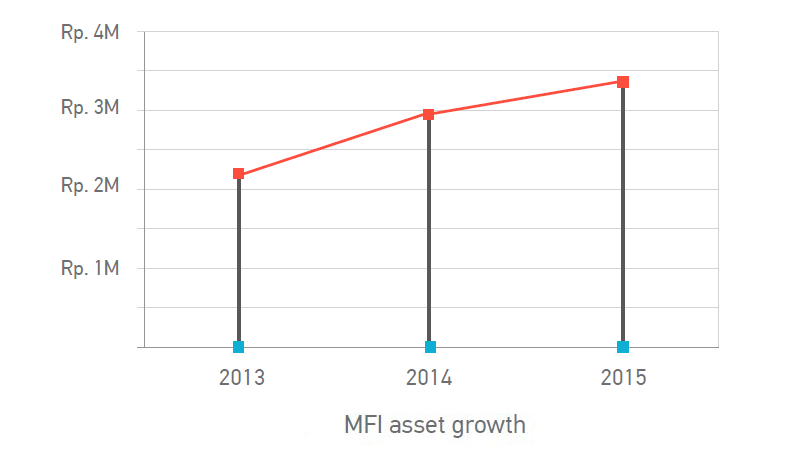

1. Three MFIs asset growth progress (in IDR billion).

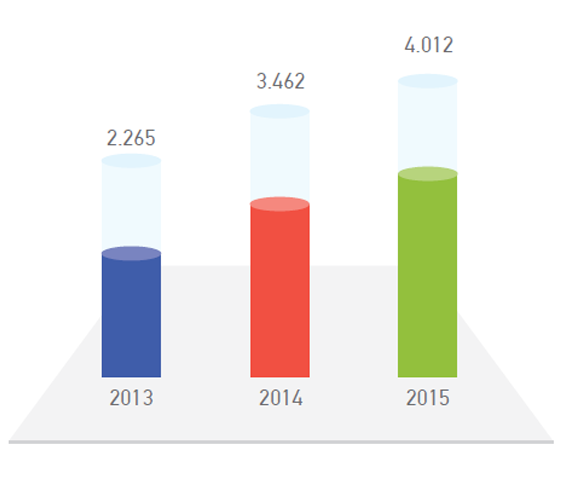

2. Three MFI member progress

Three MFI members have been increased from time to time. Currently in total, three MFIs have 4.012

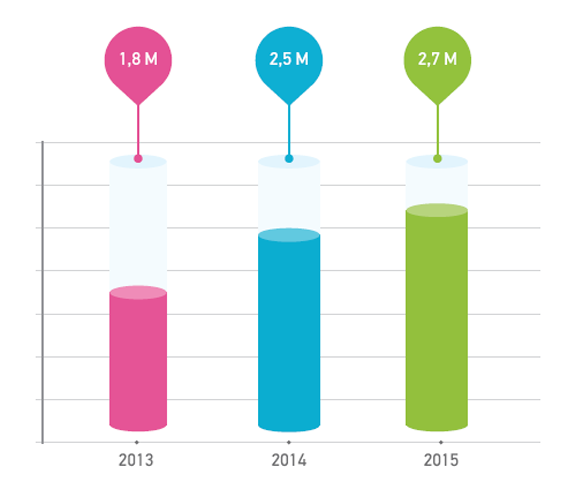

3. Level of community trust to MFI

One indicator of level of community trust toward MFI is the increased growth of community saving participation on three MFIs (in IDR billion).

4. Capacity building for three MFI continuously

One of the most important things in the development of MFI is capacity building for their staffs. All of three MFI staffs have been trained in series & diverse trainings from 2013 up until 2015 to increase their capacity to manage MFI. The trainings were:

a. Training of human resources development

Consist of training of personal development, team building, paradigm building & motivation.

b. Training of MFI operational management

Consist of training of MFI basic principle, financing management, marketing management, accounting, internal control system, MFI asset & infrastructure security management, business partnership & networking management, business plan etc.

c. Comparative study

Several comparative studies to well-established & well-succeed MFIs.

5. Training of entrepreneurship for MFI member

Starting on second operational year (2015), the three MFIs have conducted two batches of trainings for their members in form of training of entrepreneurship for MFI member who has current business activity.

b. Grameen Bank model micro financing in partnership with Koperasi Mitra Dhuafa (KOMIDA)

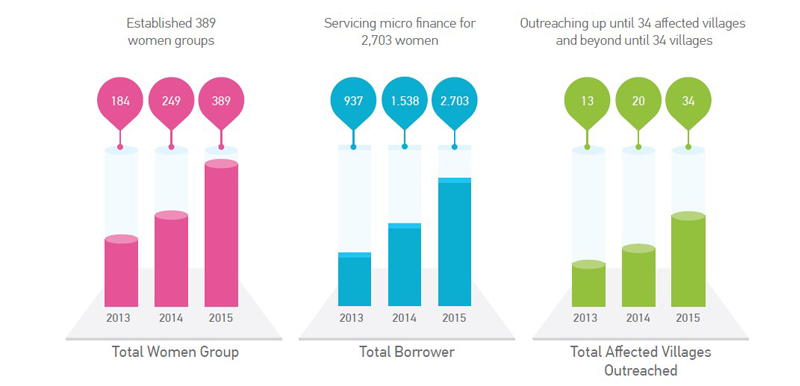

Complementary financial services for affected community with three MFIs in three villages, BPI is partnering with well-experienced and national-wide MFI Koperasi Mitra Dhuafa (KOMIDA) that specifically implementing financial service for poor women with Grameen Bank Model. The partnership has established KOMIDA Batang branch office in May 2013. Below is the implemented result until 31 December 2015

1. Financial services

2. KOMIDA member training

Besides serving micro finance for its member, KOMIDA is also providing technical assistance in form of training of health, entrepreneurship and financial literacy

3. Temporary job creation program

Community surrounding BPI that directly affected by BPI land acquisition is tenant daily famer and jasmine picker. Therefore, BPI provides opportunity beside become entrepreneur in MEG program, but also various kind of simple job that could be conducted by them in civil works or other available jobs. BPI will continue involve them

a. Work in CFPP location for affected farmer

Form of temporary job creation is land clearing, water channel installation & reforestation work.

b. Other supporting work

Form of temporary job creation is BPI merchandise production, BPI sign board and involvement as worker in BPI CSR infrastructure program.